When should I invest in a mobile strategy? I think this is a question that most marketers, technologists and broadly businesses are asking themselves now. I also think if you feel the time is now then certainly from my perspective you are setting up for success and giving yourself the right learning time so that as this space matures you are ready to capitalise.

Let’s do some math’s and apologies if some of the percentages I am quoting change by the time you read this post, in this space things are rapidly evolving.

So according to the latest Sensis Smart Phone survey in Australia by 2012, 60% of the roughly 20 million population will have a smartphone. To build on this the latest Google stats show that 79% of people use their mobile phone to help with shopping to affirm they are making the right purchase decision. Making this even more compelling a recent Microsoft survey shared that 51% of Smart Phone owners are more likely to purchase from a retailer with a mobile site & mobile experience.

On this basis the opportunity is ripe as speaking today less than 4.2% of retailers have a mobile presence.

This info-graphic is a great representation by Microsoft showing how mobile plays a part in the consumer buying experience. For a better look visit the below link:

http://rww.readwriteweb.netdna-cdn.com/assets_c/2011/06/the-intellegent-shopper-30494.php.

I think beyond potentially getting brownie points for creating a new channel & technology that let’s your business connect with customers, introducing your business to a mobile presence truly allows you to immerse your customers in Social Media & real 1:1 experience with your brand.

So hopefully if you have read this far I have provided you a rational argument for having a mobile phone presence and why I think the time is now.

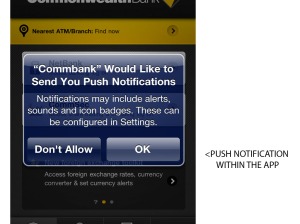

The start of having a mobile presence can start of being as simple as having a mobile site for people trying to access your online site via mobile. Where appropriate and where you have a compelling utility there is an opportunity to provide a mobile app/s (*I will shortly be writting an article about customer advocacy and the journey from a mobile site to your company app providing for true love 🙂 ).

There are two things that I would like to say at this point:

- Creating a mobile presence does not have to be exceptionally expensive, however you get one or two chances to connect with customers in such a 1:1 way so ensure your presence is a reflection of the brand image you want to create.

- A mobile strategy starts of with a mobile site, but should be inclusive of a channel strategy which encompasses a presence for Tablet devices, Mobile Apps, Social Media, your Digital Ecosystem, Retail Store Integration and how mobile devices interact within this environment (* I will talk more about this in a coming article)

So in short my advice is, the time to invest in a mobile strategy for your business is now and the more experience and comfort you get in this space the better for your businesses upcoming success.

As always this is our point of view and should you have any comments or further questions we at mobiDdiction welcome them.